Personal bank loans and you may Payday loans are accustomed to spend the money for costs or instructions that you may struggle to pay for. We all know that it’s either hard to expect whenever good sudden significance of bucks commonly happen. Personal loans and you will payday loan show one or two various other ways to getting more income in terms of mortgage size, mortgage several months, pricing, and you will official certification.

Unsecured loan

A consumer loan are financing that’s not backed by guarantee to be sure the installment. Signature loans are supplied toward creditworthiness of the person. The fresh new creditworthiness of your own borrower was analyzed in line with the five C’s off borrowing: reputation, capability, capital, guarantee, and you will criteria. Examples of personal loans is mastercard orders, personal loans, and you will student education loans.

Therefore whether or not, you don’t repay the mortgage, the lending company usually do not truly grab the possessions. The consumer loan takes 24 hours to processes; you ought to provide documents such spend stubs, bank account, taxation statements, and the like. The lending company will even have a look at your credit rating, income, costs, wealth, or other items. Currently, the lending company or other creditors fees 5% so you can 36% focus. Highest minimizing prices arrive dependent on your credit rating and credit history.

Advantages

- Safer

In place of secured finance, personal loans do not require security. Which means, the lender cannot bring your possessions if you can’t pay-off the latest financing as well as your private property isn’t at stake even in the event of a standard.

- Effortless

You can get an unsecured loan approved within just twenty-four instances, and this caters to the purpose while you are during the dreadful demand for money. But what matters here’s a good credit score and a beneficial secure revenue stream. If the both of these are located in put, following unsecured loans can be your most useful solution.

The brand new Cons

- Interest rate

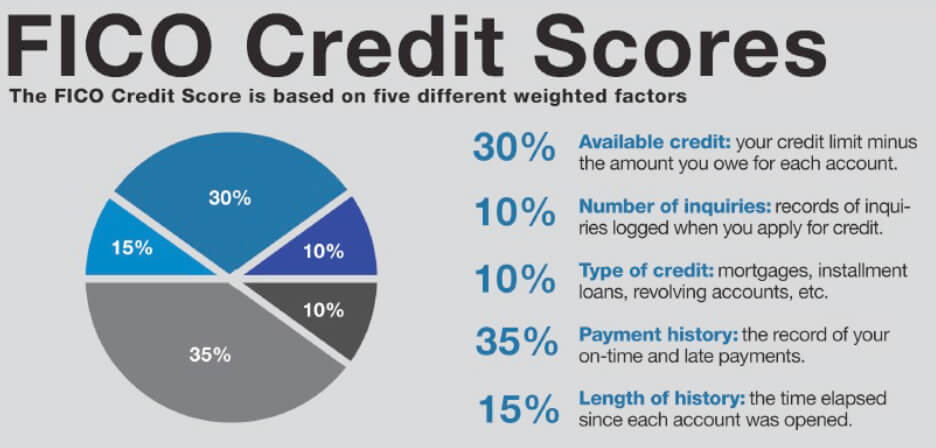

Personal loans enjoys a higher level interesting since they cannot have any equity against the loan. The rate is really as higher once the thirty-six%, and this hinges on their CIBIL rating, definition your own creditworthiness. This get means the bank while you are capable of paying off your debt. Very ensure that you take care of good credit.

- The borrowed funds matter

The borrowed funds amount can be small of the chance involved. As the establishments dont keep people collateral, loan providers tend to approve less number of mortgage. Unsecured financing is going to be good origin for short dollars injunctions, nevertheless is not able to make a serious financial support out-of a personal loan.

Payday loan

An instant payday loan is a type of small-identity credit in the event that financial needs to shell out highest-desire borrowing from the bank according to earnings and creditworthiness. Such financing are large-interest levels to own short-term bucks. Others title of one’s cash advance is cash advance loan or glance at cash loan. He could be meant to let functioning someone connection temporary cash shortages. Pay-day lenders examine an excellent borrower’s employment, bank facts, and money to set a primary borrowing limit, that may boost over time if for example the borrower retains good listing into the lender.

To acquire an online payday loan, you must fill out an application that fits specific requirements. Such, the person will be a citizen off Asia and needs to help you feel no less than 18 yrs . old. The borrowed funds has been provided as per the facts of one’s borrower. The newest deadline would be longer basically doing a month. The latest borrower is free of charge to invest the borrowed funds just before otherwise once the fresh new deadline. Thus never ever make this types of loan if you aren’t 100% sure that you can repay it.

The pros

- Simple

In which traditional finance and you will credit cards grab extended so you can techniques, getting an online payday loan was a faster procedure. You need not must fill lengthy variations; instead, the application processes is fast and simple since the most of the relationships otherwise processes inside it occurs on the web. And therefore no longer brand new awkward and you can how to get a loan with no income cumbersome sort of scheduling a consultation with lenders.

- Compatible

All of the old-fashioned money feature requirements for instance an auto loan will likely be invested in order to purchase an automible, however, an online payday loan are often used to pay some thing state even an electrical energy costs.

- Zero Security

Certain lenders require you to hope collateral so you’re able to avail the loan. However with payday loans, you don’t want security. If you have a stable source of income. i.e., a long-term jobs, then you may get a payday loan.

- No credit score

Those with a bad credit rating struggle to rating that loan. But with pay day loan, you could potentially get it even which have a poor credit score. Whatever you need is uniform money, >18 years old, Pr on the county, and you can a working account, that’s all, your ready to go discover a payday loan.

The fresh Downsides

- Pricey

The eye into cash advance vary anywhere between three hundred and you can 900 per cent. The huge expenses associated with pay day loan makes it burdensome for a debtor to get out of it. Remember that its very crucial to pay your debt from the the newest time out of growth. In case you are not able to pay-off the borrowed funds under new offered small tenure, then you may become against a premier-rate of interest one to continues to boost.

- Financial obligation cycle

Your debt is the businesses profit. Yes, its real, extremely pay day loan enterprises profit when borrowers usually do not pay back past fund become stretching its financing. It contributes a supplementary weight with the borrower. He/ she has to settle a whole lot more fees on top of the totally new amount borrowed, hence you certainly will house right up becoming a never-conclude loop.

A personal loan is appropriate if you have good credit, you would like a continual amount of cash and can afford to pay back the loan during the monthly obligations. An instant payday loan is expensive however, could be the only financial support if you have terrible or no credit rating otherwise you prefer currency in a hurry. Care and attention should be delivered to maybe not allow an online payday loan to snowball in size by constantly renewing it. Chances is up against an online payday loan debtor, therefore try to avoid it at all costs, whenever possible.