You might have to work easily to prevent lost a repayment and you can defaulting on a consumer loan. With respect to the state, you could consider an easy way to cure other expenses, refinance your debt or get assistance from the financial otherwise an effective credit therapist.

On this page:

- Whenever Is actually a personal bank loan during the Default?

- Steer clear of Defaulting towards the an unsecured loan

- Which are the Effects of Perhaps not Repaying The loan?

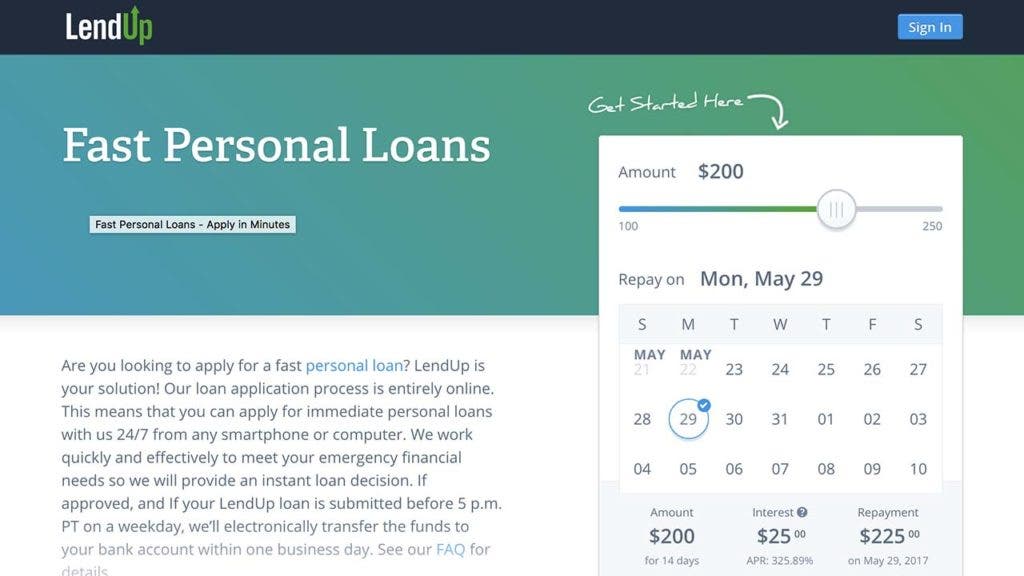

While you are unable to manage the expenses and you will envision you could miss your next unsecured loan fee, you should examine the options before it is too late. Dropping behind and ultimately defaulting to the financing may lead to even more fees and you may hurt your borrowing from the bank for many years. You happen to be able to get let or steer clear of the late fee if you operate easily.

When Try a consumer loan for the Standard?

The loan can get theoretically get in default when you first miss an installment, just like the you’re failing to follow up on terms of new financing contract your finalized. Yet not, of several personal loans (or any other consumer fund) has a sophistication months before an installment try stated to the credit reporting agencies since the late.

Even after brand new sophistication months has gone by, financial institutions can get consider your mortgage unpaid to possess a period of time prior to saying they in standard. How long your loan is regarded as delinquent relies on the financial institution, but always just after 3 to 6 months, it could be believed in the standard.

Steer clear of Defaulting on the a personal bank loan

There are some means you will be in a position to prevent lost your own personal loan commission, nevertheless the most effective way is based on your situation. Continue reading “Steer clear of Defaulting for the a personal loan”