Federal education loan Forgiveness was once a good shortly after-in-a-life options. Discover, although not, several possibilities available immediately, such as for example MOHELA student loan forgiveness .

This financial support forgiveness is just one of the creditors that can help anybody into the deciding hence cost option is suitable for Roosevelt took away a payday loan their requirements and earnings, also Professor Home loan Forgiveness apps , Income-Computed Charge Agreements (IDR), and you may Public-service Financing Forgiveness (PSLF).

When you yourself have MOHELA student loans, you can try refinancing to arrive a lesser attract. This means that, you will be in a position to reduce your monthly payments and you also will pay regarding the personal debt more readily.

When you have MOHELA college loans, you must understand how the business functions and you can shell out out-of the debt. That’s what this article inquiries.

Just like the an exclusive financial, MOHELA did having student education loans for some time. While the a national home loan servicer, it’s got remained a minor new member. But not, this new You.S. Degree Business produced in one to MOHELA perform take over FedLoan Servicing’s PSLF and Show Offer app .

MOHELA has recently already been swinging specific FedLoan account. The rest of the PSLF registration and you may Teach Promote receiver be ran a little while within the 2022.

MOHELA may also undertake of a lot debtors on earnings-passionate costs arrangements . Thus, it may be mortgage loans issues for truck drivers responsible for most funds you to definitely probably be qualified to receive money forgiveness afterwards.

MOHELA already just keeps a small % from IDR plans. Sadly, it bit is indeed moderate whenever the brand new Services from Knowledge profile education, it lump it financial support servicer to the together with other nonprofit servicers.

A term Toward MOHELA Education loan Forgiveness

Since the following quarter from 2021, the brand new REPAYE system got over $194.nine mil into the a great loans for over step three.twenty-7 mil someone. Nonprofit servicers typically (not just MOHELA) service simply just about $10.six billion during the an excellent REPAYE financing. That it looks like so you’re able to nearly 3 hundred,100000 debtors.

For that reason, it would be interesting observe just how MOHELA discusses it biggest changeover, and you will just what display out-of rates plans they’ll deal with when confronted with instance tall mortgage servicer change.

What is MOHELA?

MOHELA is simply a student-based loan repairs group situated in St. Louis, Missouri, having organizations into the Columbia, Missouri, and you may Washington, DC. MOHELA features alot more three decades of experience from industry.

MOHELA works together some body and you will alumni who’ve experienced specific monetary demands and will be offering some remedies for create costs much easier, helping her or him within their go a loans-free condition.

When you have MOHELA student loans, you should know how corporation works and you will spend the money for obligations. MOHELA could be the only servicer to own people signed up for this new Show Bring Program and you can PSLF on 2022.

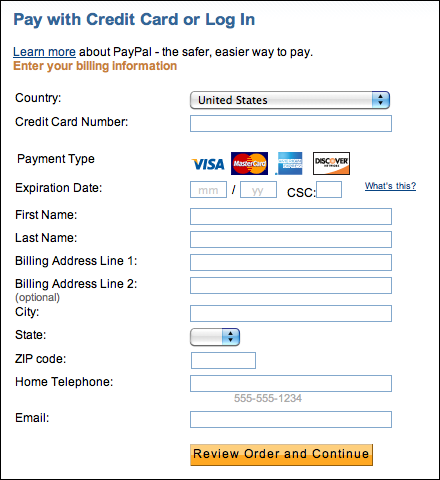

To attain on the web access to your finances, you need to register. You might get in touch with MOHELA, comprehend your month-to-month battery charging statements, and you may shell out statements after you’ve accessibility.

Register automatic money. MOHELA can deduct your finances from your checking account immediately. On top of that, you will lay aside 0.twenty-five payment affairs on your own attention of the signing up for autopay.

Sign up a passionate IDR package according to your income. From the submission a papers mode having MOHELA, you could potentially consult income-driven payment, and that reduces your education loan money so you’re able to a share of your money.

Asks for forbearance and deferment is actually canned. For people who qualify, MOHELA can assist you inside the briefly finishing purchasing costs or cutting your own monthly count. This will help to your prevent default by continuing to keep your for the an effective standing. However, appeal normally continue steadily to accrue during the attacks out-of deferment otherwise forbearance.

Procedure you to definitely-sometime monthly payments. MOHELA will keep tabs on your payments and you may collect him or her. If you want to build significantly more costs, you could potentially share with MOHELA to use them to your current harmony (on line, by the mobile phone, otherwise from the mail). Or even, the extra currency are placed on next month’s payment.