Once youve done this, youll have the total matter (often having added desire). The financial institution tend to declaration your repayments towards around three credit bureaus, increasing your credit score.

4. Get a guaranteed bank card

In contrast to unsecured credit cards, shielded handmade cards wanted an excellent refundable cover put. Your own creditor will use your put since equity, which means that theyll ensure that it it is for people who arent able to spend your costs. Constantly, extent which you pay determines your own borrowing limit.

Protected cards are a great option for building your own credit due to the fact they limit the chance you to youll accumulate financial obligation which you cant repay. After a while, you may be able to revision so you’re able to an unsecured charge card, of which point youll get the put back.

- Choose a family one to accounts towards three credit agencies

- Avoid using more than 30% of the available borrowing

- Envision setting up autopay to end later or skipped payments

5. Score credit to have investing rent and you will electric bills on time

Your own book and you can domestic bill money generally cannot end up being stated to the 3 credit reporting agencies if you don’t miss a repayment. However, for those who have debts which you constantly shell out promptly, upcoming consider one of them methods to buy them onto your credit history:

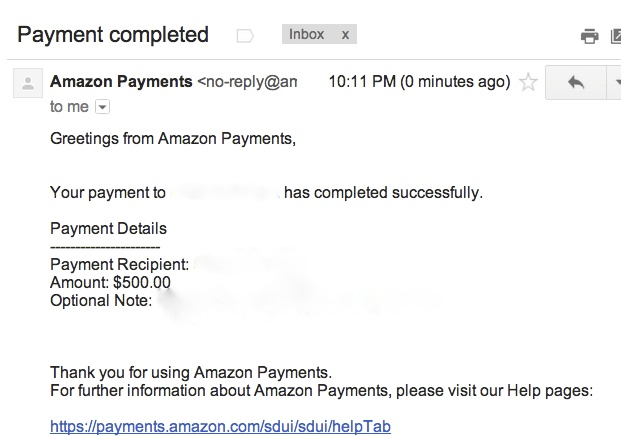

- Experian Increase: This will be a free service you should use to improve the borrowing from the bank (just with Experian, maybe not one other one or two credit reporting agencies) for making certain kinds of repayments. These are generally payments for power bills as well as subscriptions in order to services eg Netflix, HBO, and you can Hulu.

- Rent and you can costs revealing qualities: There are paid attributes including PayYourRent that will declaration their book payments to all three credit agencies and others (like eCredable) that may statement your own power costs to at least one otherwise two of her or him. Before you sign upwards for these qualities, look at to be certain the property manager or assets government organization isnt already revealing your rent and you may utilities.

- Pay your own debts that have credit cards: For folks who shell out your book otherwise power bills due to a card cards and you can continuously shell out your mastercard statement timely, upcoming theyll sign up to your credit rating.

You can utilize free credit file to monitor alterations in the credit history

I encourage providing the around three credit reports now, but you can rating next year’s records by themselves to keep track of their improvements because you create your borrowing from the bank. Ask for one report every five days to locate an idea out-of how your credit rating transform over the course of this new 12 months.

Lifetime having a 500 credit history

Until your reasonable credit history try an error for the reason that big errors on the credit file, you’ll remain in the fresh new poor diversity for around the next month or two.

Up until your own get advances, prevent taking out any so many loans to ensure that you will likely not ruin your progress by the racking up loans which you cannot pay.

There’s no credit rating also lowest discover a vehicle mortgage, however you possess issue getting one when you are your credit rating is in the worst range. You happen to be able to get a detrimental-borrowing car loan, nevertheless interest could well be seemingly large, and so the toll itll accept your finances and you may borrowing from the bank rating most likely wont end up being worth every penny.

Predicated on a 2020 questionnaire from the Experian, individuals with credit ratings from the selection of 300580 (named strong subprime consumers) got the typical interest of 20.3% to their car or truck funds, while those with credit ratings from 781850 (super-best individuals) received the common rate off step three.8%. 11 Waiting up to your score payday loans Fort Rucker advances can save you countless cash monthly and you can thousands of dollars along side lifetime of the mortgage.