Opportunity will set you back

To-be reasonable, Ramsey doesn’t advise paying off your mortgage as an initial action. The guy desires one repay any other loans earliest following start putting away 15% of your own money to stick for the shared loans. Just when you perform these items really does the guy tell you to pay off their mortgage. And therefore audio great, except there is a chance pricing to this for the majority cases.

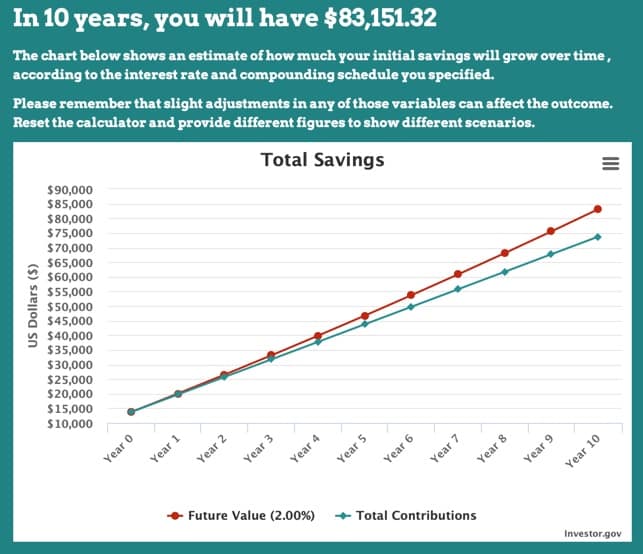

What if you have got a spare check loans Colony AL $five-hundred thirty day period right after paying any bills, together with your home loan, and you may use this currency to repay your home inside 10 years as opposed to fifteen. One sounds higher, proper?

not, can you imagine your invested it money in new inventory sey themselves, you are getting an excellent a dozen% speed out-of go back for folks who put your currency to the a list funds.

The brand new twelve% profile that Ramsey alludes to is not accurate, although not. Usually, the common more people ten 12 months period was closer to 9%.

When mortgage cost are seated near to step three%, hence, it will make a lot of feel to place your currency towards a list loans in place of paying down your financial.

Needless to say, there was a chance of an inventory ple, and everyone provides heard about 1929 and Great Despair.

Yet not, long-title, dollar-cost-average purchasing with the a list finance isn’t the same as daytrading. Over the years, along side enough time-name, you’ll create a tiny more than nine% by this means. However, if you find yourself getting close to old age, then you will want to help you move your own risk/award ratio. Continue reading “Historic Rates away from Go back against. Occasional downturns”