- People organization fees

- Furniture and equipment

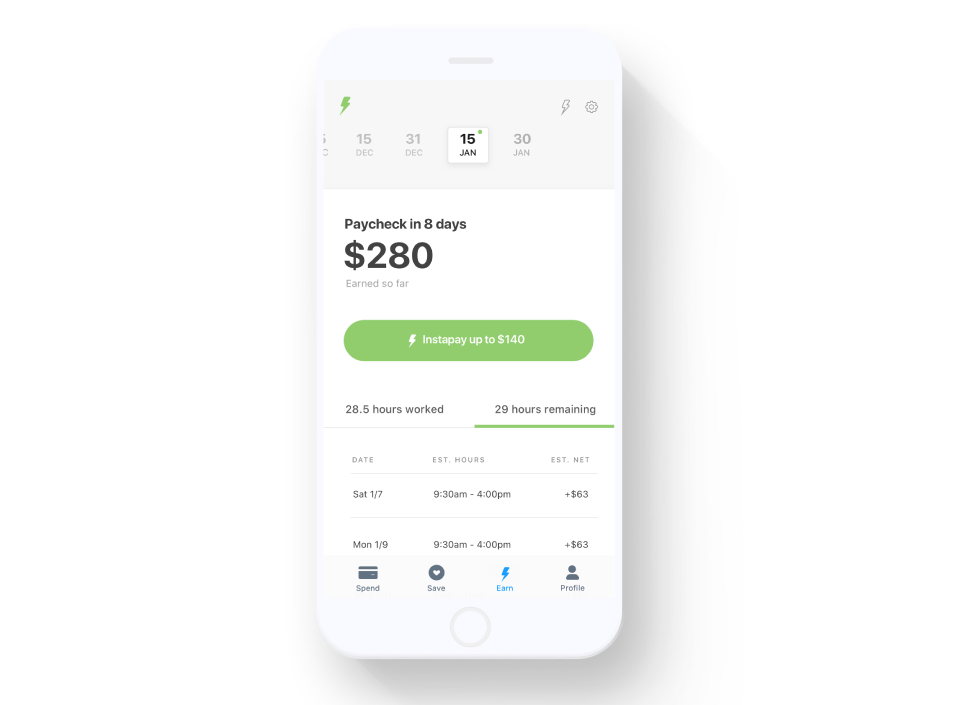

- Additional financial supplies in case of a monetary emergency

If you decide on a federal government-recognized or traditional financing, charge and rates can vary generally by financial, even for the same variety of financing, very shop around for your best deal. Meeting financing quotes out-of at the least three some other mortgage lenders can save you plenty along side life of their financial. You could start your search because of the evaluating cost with LendingTree.

For individuals who slip into hard monetary crisis, you will find several steps you can take to assist you end property foreclosure while you are doing work one thing aside. Be ready to offer paperwork and you can characters outlining your position.

Consult a good forbearance. Get hold of your mortgage servicer and request home financing forbearance. This option allows you to end and come up with repayments to own a-flat time period that will vary considering your loan servicers guidelines. Definitely comprehend the fees options adopting the forbearance period comes to an end. They typically include a substitute for pay off the entire past due harmony, making extra repayments to possess a flat time otherwise delayed brand new missed payment equilibrium payoff until you promote or re-finance your residence.

Consult that loan modification. If you aren’t eligible for a good forbearance, explore home loan amendment choice along with your loan servicer. You’re in a position to discuss a reduced interest, an extended title or a mix of one another. Make sure you track every composed communication from the bank and work easily in order to requests extra records.

What the results are in case the home loan try foreclosed?

There are two main implies a lender is also collect for people who fall trailing towards the money – from process of law inside the a method called judicial property foreclosure, or with good trustee when you look at the a method called non-official foreclosure. If you cannot help make your costs, its essential you are sure that the newest timeline and operations based on how enough time a foreclosures will need.

Judicial foreclosures. An official foreclosures was a court procedure and generally takes much longer than a non-judicial foreclosure. It offers additional time so you’re able to either are able to provide the borrowed funds most recent otherwise generate agreements with other casing preparations.

Non-official foreclosure. For people who finalized a note and you may a deed out-of faith in the your own closure, then you are most likely in a state that allows a low-official property foreclosure processes. The fresh new process of law aren’t employed in this course of action, and the foreclosure processes schedule can be much faster, causing you to be which have a shorter time while incapable of give the latest payments newest.

Preferred financial mythology

You prefer best credit discover home financing. Having bodies-recognized mortgage programs for instance the FHA, you’re recognized for a financial loan personal loans Riverside that have a credit rating as low as 500, whenever you can make a great 10% downpayment. not, loan providers will need to demonstrate your creditworthiness predicated on additional factors like your DTI ratio and cash reserves on how best to get a mortgage with bad credit.

Need a beneficial 20% down payment to get a mortgage. There are numerous lower-down-commission home loan software to choose from which need lower than a good 20% advance payment. At exactly the same time, you s available in your neighborhood.

If you’re prequalified, you are getting a home loan. Taking prequalified getting home financing simply gives you a sense of how much cash a loan provider you’ll mortgage your according to the credit score, financial obligation and you may earnings. But not, the financial institution still has to review help data files that’ll show roadblocks into the latest recognition. You’ll be able to envision delivering the full borrowing acceptance before you look during the home knowing you have got difficulties with your revenue or borrowing from the bank.

Annual percentage rate (APR). The new Apr is usually greater than your mention speed because it reflects the cost of borrowing money, according to the desire, costs and you can loan title, expressed as an annual rate. Brand new Annual percentage rate was created to make it more comfortable for consumers to contrast loans with assorted interest rates and you may will cost you, and you may federal rules demands that it is shared in all advertising. Generally, the better the essential difference between your own notice rate and you may Annual percentage rate, the more you are spending in closing will set you back.

Their rainy-big date supplies

- Fix can cost you